Overview

Sri Lanka Customs History

Our Functions

Vision and Mission

Sri Lanka Customs Anthem

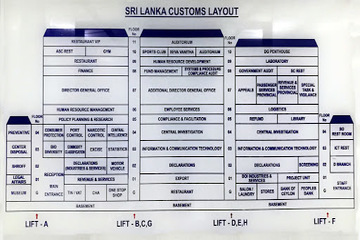

Customs Headquarters Layout

Read More about “Overview”…

Directorates and Divisions

Clusters of the Department – Human Resources, Corporate, Revenue and Services, Enforcement and Provincial Read More about “Directorates and Divisions”…

Customs Law

Download the Customs Ordinance (Chapter 235) Read More about “Customs Law”…