-

C&FD Home

-

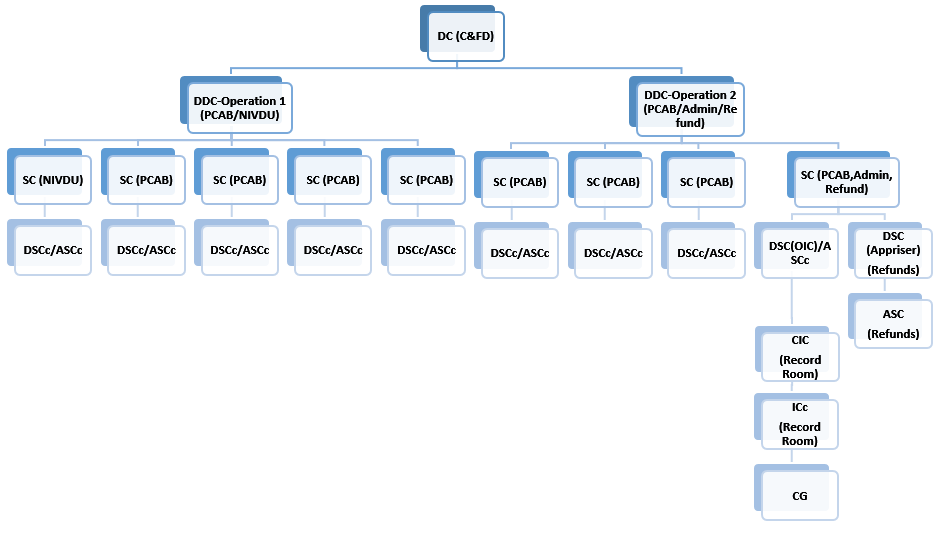

Structure

-

Objectives

& Services -

Regulations

Applied -

Post Clearance

& Audit -

Contacts

In achieving an appropriate balance between trade facilitation and regulatory control, Customs is managing two risks simultaneously; the potential failure to facilitate the international trade and potential non-compliance with Customs laws. The application of risk management principles provides the means of achieving this balance. In view of this, Compliance and Facilitation Directorate was established. The directorate consists of two units namely, Post Clearance Audit Branch (PCAB) and Refund Branch.

Public individuals and expect fare trade level playing field by providing information to this unit by Contact Us.

Consignees, Declarants, transport providers, shipping agents, banks, logistic providers, forwarding agents, clearing agents are expected to adhere to Customs law, regulations and Generally Accepted Accounting Principles in their financial reporting within their accounting systems.

Objectives of the Division

- To facilitate trade by improving compliance level of stakeholders including Consignee, Declarants, Shipping Agents, Banks and Exporters.

- To maintain the level playing field for traders & promote fair trading by identifying consignees who are non-compliant with rules & regulations of Customs & other related laws.

- Recovering short-paid levies, including penalties where fraud is established.

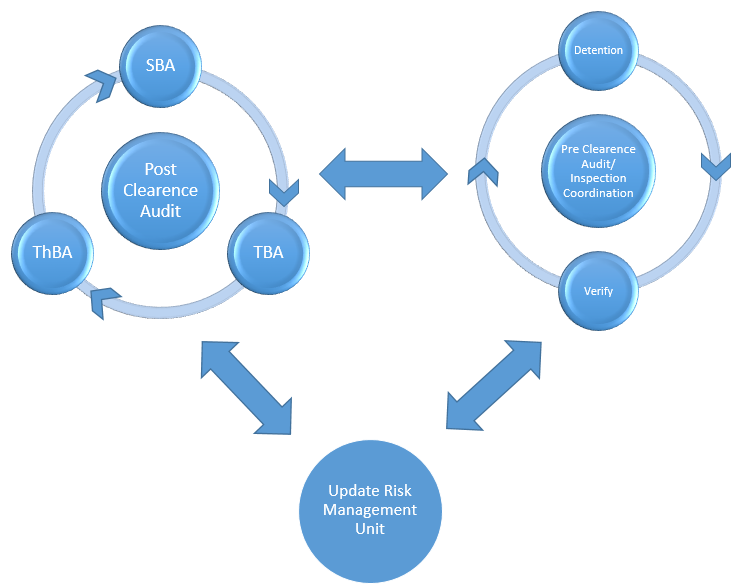

- Conducting System Based Audits, Transaction Based Audits and Theme Based Audits for companies, institutions who are engaged in import & export activities while coordinating with the Risk Management Unit, investigation units, Valuation Division & Cargo Examination Division (CED) to meet the objectives of the department.

- Processing refund claims submitted by consignees/Importers/Exporters.

- Custodian of warrant copies of CUSDECs.

Services

- Issuing certified warrant copies & related documents to consignees on request & payment of charges (Regulations Applied).

- Receiving applications of refunds for Duty, VAT, PAL, etc. processing and appraising for payments (Regulations applied).

- Receiving information from persons regarding frauds by Consignee, Declarants, etc.

- Performing Post Clearance Audits such as System Based Audits (SBA), Transaction Based Audits (TBA) & Theme Based Audits (ThBA) to give feedback to Risk Management Unit (RMU) to facilitate Authorized Economic Operator (AEO) program & selectivity criteria for inspection of consignments of imports/exports.

Regulations Applied

- Obtaining certified copies of warrant copies of CUSDECs & other relevant documents

- Only the consignee or any person authorized on their behalf can get copies of such documents. The Right to Information (RTI) is applied subject to statutory obligation to keep certain information confidentially.

- Refund Applications;

- Duty/VAT/PAL/Excise Refunds – Sec. 18 of Customs Ordinance

- Draw back applications – Sec. 22 of Customs Ordinance

- Post Clearance Audit (PCA);

- Sec. 128 of Customs Ordinance

- Sec. 128A of Customs Ordinance

- Sec. 47 of Customs Ordinance

- Sec. 52 of Customs Ordinance

- Sec. 12, 43 of Customs Ordinance

- Obligation of Auditee to keep records;

- Sec. 8(2) of Customs Ordinance

- Sec. 51B of Customs Ordinance

- Sec. 9(1) of Customs Ordinance

- Company Act (No. 7 of 2007)

- Sec. 144 of Customs Ordinance

- Sec. 18(3)of Customs Ordinance

- Generally Accepted Accounting Principles in Sri Lanka

- Value Declaration for Imports

- Mandatory Declaration

- Relevant applicable provisions of Customs Ordinance – Sec. 51 read with Schedule E

- Gazette No. 1335/25 April 10th 2004

- NIVDU (National Import Valuation Database Unit) – https://nivdu.customs.gov.lk

Reference:

- Sec. 8 (2) & 9 (1) of Customs Ordinance – https://www.customs.gov.lk/wp-content/uploads/2021/06/PART-I.pdf

- Sec. 12, 18 & 22 of Customs Ordinance – https://www.customs.gov.lk/wp-content/uploads/2021/06/PART-II.pdf

- Sec. 43, 47, 51 & 52 of Customs Ordinance – https://www.customs.gov.lk/wp-content/uploads/2021/06/PART-IV.pdf

- Sec. 128, 128A & 144 of Customs Ordinance – https://www.customs.gov.lk/wp-content/uploads/2021/06/PART-XIII.pdf

- Company Act (No. 7 of 2007) – http://www.drc.gov.lk/en/wp-content/uploads/2018/04/Act-7-of-2007-English.pdf

Post Clearance Audit

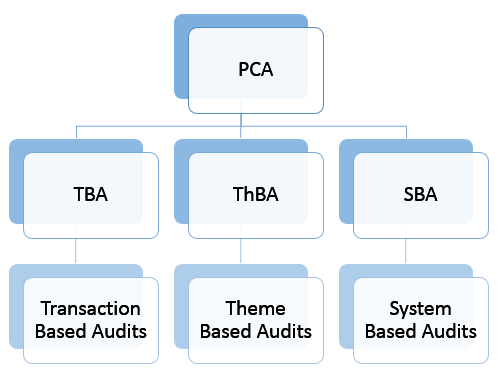

PCA are of 03 Categories.

PCA Approach

Contact Details

Email Address: cnf2@customs.gov.lk

| Designation | Telephone (Direct Line) | Extension |

|---|---|---|

| DC | +94 112 221540 | 7540 |

| SDDC 1 (PCA Group 1 & 2/Refund) | +94 112 143434 (+94 713597467) | 7542 |

| SDDC 2 (PCA Group 3 & 4/Admin) | +94 112 143434 | 7541 |

| DDC Admin/Refund | – | 7543 |

| DDCc (Team 01 & 02) | – | 7545/ 7548 |

| DDCc (Team 03 & 04) | – | 7549/ 7550 |

| DDCc (Team 05 & 06) | – | 7553/ 7562 |

| DDCc (Team 07 & 08) | – | 7559 |

| ASCc (Team 01 & 02) | – | 7560 |

| ASCc (Team 03 & 04) | – | 7547 |

| ASCc (Team 05 & 06) | – | 7544 |

| ASCc (Team 07 & 08) | – | 7551 |

| DSCc (Refund Appraiser) | – | 7557 |

| ASCc (Refund) | – | 7554 |